Indian States, Karnataka and Delhi top the India Innovation Index 2020 ranking

NITI Aayog released the second edition of India Innovation Index on January 20, 2021. The report provides a comprehensive overview of the innovation infrastructure and performance of the states and the union territories. It is also an objective of the report to instill a healthy competitiveness among the states and the union territories thereby promoting competitive federalism.

The states and union territories were categorized into three categories, viz., Major states, Union Territories / City States and North-East and Hill States.

Among Major states, Karnataka topped the group followed by Maharashtra and Tamil Nadu. Among Union Territories / City States, Delhi took the pole position followed by Chandigarh and Daman & Diu. Finally, among NE and Hill states, Himachal Pradesh ranked first followed by Uttarakhand and Manipur.

Complete rankings:

|

Rank |

Major States |

Score |

|

1 |

KARNATAKA |

42.50 |

|

2 |

MAHARASHTRA |

38.03 |

|

3 |

TAMIL NADU |

37.91 |

|

4 |

TELANGANA |

33.23 |

|

5 |

KERALA |

30.58 |

|

6 |

HARYANA |

25.81 |

|

7 |

ANDHRA PRADESH |

24.19 |

|

8 |

GUJARAT |

23.63 |

|

9 |

UTTAR PRADESH |

22.85 |

|

10 |

PUNJAB |

22.54 |

|

11 |

WEST BENGAL |

21.69 |

|

12 |

RAJASTHAN |

20.83 |

|

13 |

MADHYA PRADESH |

20.82 |

|

14 |

ODISHA |

18.94 |

|

15 |

JHARKHAND |

17.12 |

|

16 |

CHHATTISGARH |

15.77 |

|

17 |

BIHAR |

14.48 |

|

Rank |

UT/ City States |

Score |

|

1 |

DELHI |

46.60 |

|

2 |

CHANDIGARH |

38.57 |

|

3 |

DAMAN & DIU |

26.76 |

|

4 |

PUDUCHERRY |

25.23 |

|

5 |

GOA |

24.92 |

|

6 |

DADRA & NAGAR HAVELI |

22.74 |

|

7 |

ANDAMAN & |

18.89 |

|

8 |

JAMMU & KASHMIR |

18.62 |

|

9 |

LAKSHADWEEP |

11.71 |

|

Rank |

NE/ Hill States |

Score |

|

1 |

HIMACHAL PRADESH |

25.06 |

|

2 |

UTTARAKHAND |

23.50 |

|

3 |

MANIPUR |

22.78 |

|

4 |

SIKKIM |

20.28 |

|

5 |

MIZORAM |

16.93 |

|

6 |

ASSAM |

16.38 |

|

7 |

ARUNACHAL |

14.90 |

|

8 |

NAGALAND |

14.11 |

|

9 |

TRIPURA |

12.84 |

|

10 |

MEGHALAYA |

12.15 |

The report is a useful indicator for the states and union territories to retrospect their policies and prevailing innovation ecosystem and come up with more aggressive intellectual property policies and schemes to improve the innovation capabilities of their state.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

A Blown Fuse for Edison’s bulb? Lights out at the IPAB (Intellectual Property appellate board in India)

In what is a cause for concern for inventors, proprietors and IP agents alike, a series of events from two branches of government has muddied the future for Intellectual Property registration in India. The first impact came via a decision passed by J. Ravindra Bhat of the Supreme Court, in a three-judge bench case in The International Association for Protection of Intellectual Property (India Group) v. Union of India and Ors., wherein the Court refused to extend the term of the incumbent Chairperson of the IPAB, J. (retd.) Manmohan Singh of the Delhi High Court.

The case ultimately involved interpretation of two prior cases alongside the Finance Act of 2017. The first issue before the court was whether the term of the incumbent Chairperson had been extended to 5 years by virtue of the decision of the Supreme Court in Madras Bar Association v. Union of India. This issue arose due to the fact that an Order by the Central Government had stated the end date of the term of J. (retd.) Manmohan Singh as 21.09.2019, i.e. the end of his tenure in a prior post held by him.

The Court therefore resorted to the fact that the incumbent Chairperson’s appointment had been made under the erstwhile 2017 Rules pertaining to the appointment of members to tribunals and relied on the decision passed in Rojer Mathew v. South Indian Bank Ltd., wherein all appointments were to be determined according to their parent act. Therefore, the term of the Chairperson of the IPAB was determined as per Section 86, i.e. upon reaching the age of 65 years. J. (retd.) Manmohan Singh turned 65 on September 22, 2019. Additionally, the Court held that the Finance Act 2017 only specified the outer limit for tenure of the Chairperson and noted that since the Central Government order had already specified that September 21, 2019 was to be the end of the term of the Chairperson of the IPAB, the outer limit would not be applicable.

An additional point of contention was with respect to the requirements under Section 84, and the effect of Section 87 on the same. The Applicant had contended that under Section 84 of the Trademark Act, the Board could not function without a judicial member, and since J. (retd.) Manmohan Singh was the only judicial member, his appointment had to be extended. The Court however noted that as per Section 84(3), the Chairperson can perform the duties of a Judicial member or a Technical member, as the case may be. The Court also pointed out that as per Section 87 of the Act, the Vice-Chairperson or any other senior-most member can carry out the functions of the Chairperson in his/her absence. In support of this point, the Court made note of the fact that the other technical members all possessed legal qualifications, and had significant experience in their field, such that they could perform the functions of the Chairperson with ease. Thus, the Court ruled out the final contention of the Applicant.

The next chapter in this story comes with the introduction of a draft bill in the Lok Sabha titled “The Tribunals Reforms (Rationalisation and Conditions of Service) Bill, 2021”. Of specific note is Chapters III, V, VII, VIII and IX, which pertain to the gambit of Intellectual Property Laws in force. In all these Chapters, amendments have been brought to substitute the use of the term ‘Appellate Board’ with that of the term ‘High Court’, wherever power has not been granted to the courts to hear the matter. In places where the courts are a permissible forum to approach, mention of the term ‘Appellate Board’ has been omitted. The needle in the haystack is that in the Copyright Act, mention is made of ‘Commercial Courts’, which has been defined to mean the Commercial Courts established under Section 3 of the Commercial Courts Act, 2015, or the commercial division of the High Court under Section 4 of the same Act.

The Statement of Object and Reasons provided in the Bill points to that fact that in spite of the existence of these tribunals, there has been a lack of speedy delivery of justice, and the Tribunals that are proposed to be shut down are ones where the public at large is not a litigant. Furthermore, such cases do not end at the tribunal level, and are litigated up till the Supreme Court. Thus, given the burden on the exchequer and the administrative costs involved in maintaining the specified tribunals, the Bill proposes to shut them down and transfer their functions to existing establishments.

What this means for the IP community is that existing as well as future cases that were originally dealt with by the IPAB will now have to be litigated at the High Courts. The high technicality of this field would pose a burden on respective High Courts in having to deal with appeals from the Intellectual Property offices, for the present judges may not possess the requisite abilities to deal with such technicalities. This would only frustrate the process and prolong the period for prosecuting an appeal from the decision of the Controller, which would hamper the innovative temper of the country.

Another possible oversight that the Bill poses is with regards to Section 64 of the Patents Act 1970. Section 64 reads thus:

“Subject to the provisions contained in this Act, a patent whether granted before or after the commencement of this Act, may, be revoked on a petition of any person interested or of the Central Government by the Appellate Board or on a counter-claim in a suit for infringement of the patent by the High Court on any of the following grounds, that is to say…”

The Bill aims to delete the phrase “by the Appellate Board or”, which leaves the Section reading thus –

“Subject to the provisions contained in this Act, a patent whether granted before or after the commencement of this Act, may, be revoked on a petition of any person interested or of the Central Government on a counter-claim in a suit for infringement of the patent by the High Court on any of the following grounds, that is to say…”

A straightforward and simple reading of the amended Section leads to the interpretation that petitions seeking to revoke a patent may only be filed in a case of infringement filed by the original patent holder. The only other mechanism to revoke a patent would be under the provisions of Section 25 of the Patent Act, specifically sub-section (2), pertaining to the Post-Grant Opposition proceedings instituted before the Controller. Thus, parties would not be able to seek the revocation of a patent after the statutory period of 1 year, until and unless the patent holder institutes a case of patent infringement.

Given the numerous timelines that exist in both the national patent system as well as the international patent system, and the fact that it is humanly impossible to account for all possible prior art at the time of examination, it is detrimental to the objective of building a strong patent system to remove a mechanism that allows for the invalidation of a patent at any given point in time.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

GRANT OF INTERIM INJUNCTION TO LUNDBECK AND INTERPRETATION OF THE TERM “EXPORT”

A patent titled “Pharmaceutical Composition Comprising Phenyl Piperazine Derivatives as Serotonin Reuptake Inhibitors” (Patent number -IN227963) was granted to H LUNDBECK A/S & ANR on 27 December 2009. The IIN name of the molecule for which Lundbeck A/S obtained patent is Vortioxetine (anti-depressant drug).

The Plaintiff alleged that the defendants manufactured and exported substantial quantities of generic version of VORTIOXETINE to Latin America and Canada. Further, based on information received from an independent investigation agency appointed by the plaintiff, the defendants had imported the API Vortioxetine thrice in 2016 and were engaged in export of substantial quantities of Vortioxetine Hydrobromide to other countries. It further alleged that Defendant No. 2 (nowhere the name of the second defendant is mentioned) sought environmental clearance at Telangana to expand the manufacturing capacity of Defendant’s unit which includes manufacturing various products, one among the list of products being Vortioxetine Hydrobromide.

The defendants argued that the drug was not used in India, and the export of the drug was solely for research and development purpose. However, the defendants failed to provide any evidence which clarifies that the use of the drug was solely for research and development purpose.

The Delhi High court rejected the arguments presented by the defendants as they failed to provide any evidence in support of their arguments. Further, the court interpreted the term “Export from India” as “Use in India” and granted an interim injunction to the plaintiff.

Learned counsel for the defendants states that the defendants are not using the product in India but exporting it for the purposes of research and development purposes. However, at the moment, there is no material to come to this conclusion that this substantial amount of exports is only for research and development purposes. Further, under Section 107 of the Patents Act, export of the products from India would amount to use of the product in India.

Considering the averments in the plaint as also the documents filed therewith, this Court finds that the plaintiffs have made out a prima facie case in their favour and in case no ex-parte ad-interim injunction is granted, the plaintiffs would suffer an irreparable loss. The balance of convenience also lies in favour of the plaintiffs and against the defendants. Consequently, an ad-interim injunction is granted in favour of the plaintiffs and against the defendants in terms of prayer (i) and (ii) of para 23 of IA 12589/220 till the next date of hearing before this Court.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

IPAB’s recent order provides clarity on divisional applications in India

What is a divisional application?

A divisional patent application is derived from a previously filed patent application which relates to more than one invention or inventive concept. Such applications fall under purview of section 16(1) of the Indian Patents Act, 1970.

Ambiguities before IPAB:

Over the years, IPO and patent lawyers maintained the ideology that divisional applications could be filed at any time before the grant of the patent, if desired by applicant. This provision was adopted to certain cases when applicants were not able to comply with statutory time period for placing the application for grant. In scenarios like these, in order to claim the priority date, applicants used to file a divisional application, with similar claims as those present in the parent application, just before the due date expired. The ambiguity lied in the matter that whether such applications were supposed to be allowed or rejected. These matters soon reached IPAB for clarification and laying out right approach when filing a division application.

The provision of divisional applications was also utilised in order to claim subject matter that were rejected for reasons corresponding to not being patentable subject matter under Section 3 of the Patents Act. As an example, applicants whose prior applications based on chemical compositions that were denied for being not patentable, started filing divisional application essentially claiming the same invention as the parent application. This interpretation led to allowing many divisional applications whose parent application was rejected. The IPAB was required to clarify the position of such application with legal perspective.

ESCO Corporation v. Controller of Patents and Designs, New Delhi

In a recent order (OA/66/2020/PT/DEL) by IPAB dated October 27, 2020, the IPAB allowed the appeal filed by ESCO Corporation (Appellant). The Appellant bears a patent application numbered 8094/ DELNP/ 2008 which got rejected by Controller of Patents and Designs, New Delhi (Respondent). The Respondent refused the grant of patent on the ground that the application failed to meet the requirements of Section 16(1) of the Patents Act, 1970. In this case of applicant, the parent and divisional applications were examined by different Controllers.

Brief facts of the case:

- The Applicant had filed the first application no. 4702/DELNP/2005 (hereinafter referred as parent application) with 56 claims, out of which claims 1-46 were related to “Wear assembly”. The claims 41-52 were related to “Wear member” and claims 52-56 were related to “a method of attaching a wear member to a support branch”.

- These claims underwent further amendments leading to retainment of only 34 claims. The claims 1-14 were related to “A wear assembly” and claims 15-19 were related to “a method” and claims 20-28 were related to “a lock” and claims 29-31 were related to “a wedge” and rest 32-34 were related to “a wear member”.

- An objection was raised in the first examination report of the parent application that claims 20-34 were inconsistent with claim 1 and plurality of independent claims existed. In response, the Applicant filed a divisional application (8094/DELNP/2008) corresponding to the current application with claims 20-34. In the first examination report issued for the current application -8094/DELNP/2008, an objection was raised under section 16(3) of the Patent Act by Controller for the claims 13-15 related to “A wear member” which corresponded with the claims 32-34 of the amended claim set of the claims 1-34 of the parent application. In response, the Applicant amended the claim set such that only claims 13-15 were retained as claims 1-3 in the current application.

- The Controller objected on grounds that the claims 1-3 did not relate to an invention distinct from claims in the parent application, since the wear member was already a feature of the wear assembly claimed in the parent application. Hence, the divisional application was illicit. The application no. 8094/DELNP/2008 was refused due to non-compliance with requirements of Section 16(1) of the Act.

Reasonings by the IPAB:

- A patent application is supposed to be divided if the claims pertaining to the parent application include “more than one invention”. The IPAB reached this conclusion by accounting legal provisions of Section 7, Section 10(5) and Section 16 of the Act, MPOPP for divisional application and recent orders- OA/6/2010/PT/KOL (L.G. Electronics); OA/47/2020/PT/DEL (Proctor & Gamble); and OA/21/2011/PT/DEL (National Institute of Immunology).

- The term “one invention” corresponds to the claims of the complete specification related to either “single invention” or could be “a group of inventions linked so as to form a single inventive concept”. This conclusion of the IPAB was based particularly on legal provisions of Section 7 and Section 10(5) of the Act. The order recites that “no two invention(s) can be allowed in a single patent application unless it conforms to a single inventive concept. Hence, either way, it is a single inventive concept which is allowable in one application, as per the statutory provisions”.

- In the case of 4702/DELNP/2005, the IPAB acknowledged that all the claims 1-34 of the parent application could have been allowed with the suitable amendments as they relate to a single inventive concept. However, the Applicant filed a divisional application based upon the objection by the Controller in the first examination report of the parent application. Further, the IPAB made an observation that the filing of the instant divisional application for the parent application does not lead to double patenting issues and hence allowed the divisional application.

Listings by IPAB:

The IPAB relied on legal provisions of Indian Patent law, the Manual of Patent Office Practice and Procedure, the PCT and the previous orders issued to list down the following key points to be looked into while addressing issues concerning divisional applications.

Points to be considered before filing divisional application:

- If applicants desire on their own accord (Suo-moto), they can file a divisional application.

- The applicant may file a divisional application in order to find solution to an objection raised on the ground of plurality of invention in the parent application. The existence of a plurality of invention in the parent application is the crucial and mandatory for filing a divisional application.

- The divisional application should not be filed with the same set of claims as the parent application.

- Division of the parent application should be exercised on the ground of ‘plurality of invention’ as contemplated under section 16 of the Act.

- The application shall exist and no divisions can be made from applications that are either “deemed to be abandoned”, ‘withdrawn” or “refused”. In addition, after the filing of the divisional application, the divisional application will continue and the legal status of the parent application will not affect the divisional application.

- The divisional application can be filed any time until the grant of patent.

- The complete specification of the divisional application should not include any subject matter not disclosed in the complete specification of the parent application. Any additional claims which never formed part of the originally filed claims and complete specification shall not be allowed in a divisional application.

Points to remember while examining the divisionals:

- The fact that there are different embodiments in the specification, claimed as an independent set of claims, does not mandate the application to fall under lacking “unity of invention”. The applicant must be given an opportunity to amend the claims to overcome such objections. As a matter of fact, an outright objection on the plurality of inventions should not be given, just because there are different embodiments in the specification.

- In scenarios where there is plurality of inventions in the claim set, while examining such applications, the distinct inventions need to be identified in the First examination report (FER) in order to reduce the needless legal complications.

- If two or more divisional applications are filed based on a first mentioned application or parent application, then the examination of subsequent divisional application(s) shall be done vis-a-vis the first-mentioned application and other divisional application(s) examined earlier, in order to avoid double patenting.

- When an objection on the unity of invention is raised in the examination of the first-mentioned application, the divisional application should be allowed if it fulfils all statutory requirements. The applicant should be given an opportunity to make amendments accordingly.

Clarifications put forth by IPAB:

- The applicant can file a divisional application only if the claims of the invention pertaining to the parent application do not relate to a single invention. The IPAB also shed light on the fact that, even though an applicant possesses the right to file a divisional application on their accord, this right is debatable and subject to the Controller’s discretion whether to allow or discard such application.

- If claims in the parent application are overlapping with those in the divisional application, the Controller may ask the Applicant to amendment the claims to remove such overlap. In other words, the divisional application should not include any claim that has been present in the parent application.

- The subject matter disclosed in the divisional application should not include any matter that has not been disclosed in the complete specification of the parent application. In order to become eligible as a divisional application under section 16, it is crucial that the parent application, from which the divisional application is filed, should disclose more than one invention.

The instant order (OA/66/2020/PT/DEL) by the IPAB aims at providing clarity regarding filing and prosecution of divisional applications. The present order has taken into account the provisions in the statute, the legal bindings of PCT, the jurisprudence and provides a set of legal guiding principles that aim to provide consistency and uniformity in evaluation and examination of divisional applications.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

Members of European Parliament back India-South Africa proposal for suspension of COVID-19 vaccine patents

The Proposal:

In early October, India and South Africa had jointly proposed for a moratorium to the Trade-Related Aspects of Intellectual Property (TRIPS) agreement that protects intellectual property and international trade, vis-a-vis the current pandemic. It was argued that the TRIPS agreement was going to delay an affordable access of COVID–19 related medical products and the R&D related to manufacturing and supply of the COVID–19 related products. The two countries called for a global solidarity for supporting the means to respond to COVID–19 rapidly. They argued that a waiver of the TRIPS treaty for a specific period of time can allow manufacturing of generic versions of the potential vaccine without violating any of the international trade rules by speeding up the collaboration among WTO member-states.

The Debate:

Many developed countries and a few developing countries were of an opinion that a solution can be found within the TRIPS agreement itself without having to waiver few provisions of the TRIPS agreement on COVID related products. They argued based on the following:

- Countries can resort to an alternative way such as compulsory licensing or government use of a patent without authorization of the proprietor.

- IP offices of Individual Countries may opt to undertake fastrack programs to speed up the granting of COVID related IP to facilitate dynamic trade landscape. For instance, the US Patent and Trademark Office (USPTO) recently initiated a Covid-19 Prioritized Examination Pilot Program.

- The opponents of the waiver pointed out that the Article 73 in the TRIPS agreement that refers to the security exceptions for member countries allowing exceptions to be considered for national security purposes. However, some entities have also resorted to “Open COVID pledge” in order to offer free licenses to others, thereby concluding that IP is not a stopper but a catalyst for finding the best solution for the pandemic.

Recently, 14 members of the European Parliament (MEPs) have backed the India-South Africa proposal for TRIPS waiver citing the need to allow the sharing of technology, data, know-how, allowing generics manufacturers to contribute to increasing global availability, including through support for India and South Africa's proposal at the WTO. This waiver once implemented would provide a broad policy space for the WTO members to meet the needs of their constituents during the pandemic crisis.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

Reworking the Statement of Working: The Patent (Amendment) Rules, 2020

On 19 October 2020, the Government of India notified the Patent (Amendment) Rules, 2020, which, among other things, brought the first modern change to the Statement of Working. Patentees and licensees had for a long time been faced with answering the myriad ambiguous questions contained in the Form 27, and so, quite possibly owing to a direction from the Delhi High Court in Shamnad Basheer v. Union of India and Ors., the Government of India revamped the requirements under Form 27. The changes have been captured below:

|

Requirements under Form 27 prior to the Patents (Amendment) Rules, 2020 |

Requirements under Form 27 post the Patents (Amendment) Rules, 2020 |

|

PROS |

|

|

A patentee would have to file a separate Statement of Working for each patent he holds. |

A patentee can file a single Statement of Working for all related patents, i.e., all patents involved in a single product, subject to the fulfillment of certain criteria. * |

|

In case of joint applicants, each patent holder would have to file a Statement of Working. |

Joint patent holders can now file a single Statement of Working. |

|

Quantum as well as value of the patented product in exhibiting proof of the working of the patent had to be submitted. |

The Statement of Working now only requires the approximate value accrued in India. # |

|

Patentees and licensees had to specify as to whether the “public requirement” of the patent had been met, based on ambiguous terms like ‘partly or adequately’, ‘fullest extent’, and ‘reasonable price’. |

The need for specifying the meeting of public requirement has been done away with. |

|

The Statement of Working had to be filed for every calendar year, and within 3 months from the end of the calendar year, i.e., by March 31st. |

The Statement of Working has to be filed for each financial year, and within 6 months from the end of the financial year, i.e., by September 30th. ^ |

|

CONS |

|

|

Patentees and licensees could file a joint Statement of Working. |

Every patentee and every licensee (exclusive or otherwise) will have to file a separate Statement of Working. However, patentees need not specify the licenses given out in a particular year. |

* – In order to qualify as related patents, the situation must be such that the (i) approximate revenue accrued from a particular patented invention cannot be derived separately from the approximate revenue accrued from the other related patents, and (ii) all patents have been granted to the same patentee(s).

# – However, patentees and licensees must still provide the differentiation in working through manufacturing in India, and importation into India. However, they no longer need to specify the country-wise details of importation.

^ – The new Rules clarify that the Statement of Working must be filed for the financial year immediately following the financial year in which the patent was granted. Ergo, if the patent was granted on 1st December 2020, the patentee would have to file the Statement of Working only for the next financial year onwards, i.e., for 2021-2022, and therefore the last date to submit the Statement of Working would be September 30, 2022.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

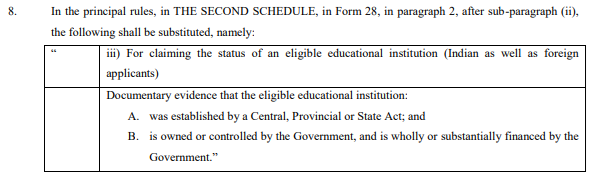

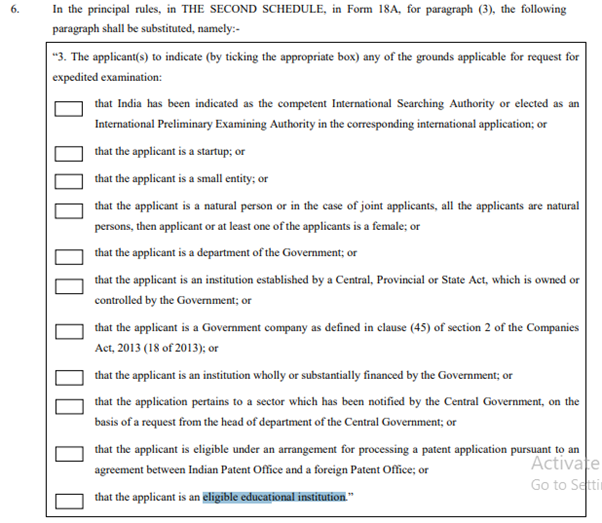

The Draft Patents (Amendment) Rules, 2021 recognises certain “Eligible” Educational Institutions

On February 09, 2021, the Ministry of Commerce and Industry notified the Draft Patents (Amendment) Rules, 2021 to further amend the Patents Rules, 2003, for public opinion.

The following amendments have been proposed:

Definition of “eligible educational institutions” added:

Rule 2 (ca) provides that “eligible educational institution' means an institution established by a Central, Provincial or State Act, which is owned or controlled by the Government, and is wholly or substantially financed by the Government.”

Form 28 filing required:

Second Proviso to Rule 7(1) is substituted by which, all “eligible educational institutions” must pay the requisite fee along with a Form 28 to claim the status.

The applicant is required to provide documentary evidence that the Applicant is established by a Central, Provincial or State Act, which is owned or controlled by the Government, and is wholly or substantially financed by the Government

Form 28 in the Second schedule has been updated to provide for the same:

Eligible for expedited examination:

Rule 24C is amended to include “eligible educational institution”. An applicant claiming such status may opt for expedited examination process.

Form 18A of the Second schedule has been amended to include “eligible educational institutions:

Fee concession:

First Schedule, which specifies the filing for patent, has been substituted. Now, eligible educational institutions shall pay the same fees as natural persons, start-ups and small entities.

Further, Rule 7 (3), which specifies the processing of application, has been substituted, namely:

“In case an application processed by a natural person, startup, small entity or eligible educational institution is fully or partly transferred to a person other than a natural person, startup, small entity or eligible educational institution, the difference, if any, in the scale of fees between the fees charged from the natural person, startup, small entity or eligible educational institution and the fees chargeable from the person other than a natural person, startup, small entity or eligible educational institution, shall be paid by the new applicant along with the request for transfer.”

Note: The draft amendment rules are open to objections/suggestions for a period of 30 days from their date of notification. Such Objections/ suggestions may be addressed to the Secretary, Department for Promotion of Industry and Internal Trade, Ministry of Commerce and Industry, Government of India, Udyog Bhawan, New Delhi- 110011 or by e-mail at [email protected].

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

New Spotify patent reveals technology to suggest music based on User emotion

Various companies have been using data inputs from users to provide users personalized contents, be it advertisements or media, and Spotify expresses that it would be using data inputs to determine the mood of the user for recommending media or advertisements based on the instant mood of the user.

“It is common for a media streaming application to include features that provide personalized media recommendations to a user”, Spotify explained in the application.

The patented technology uses recordings with Users’ speech and respective background noise to determine specific patterns. The technology is designed to process content metadata (relating to User’s speech) and environment metadata (relating to background sounds/ ambient sounds) from the recordings. The content metadata is used to determine user’s age, gender, emotional state, accent, etc. The technology is designed to extract intonation, stress and rhythm to detect the emotional state of the user. The emotional state of the user is basically categorized as happy, sad, angry, afraid and neutral.

As mentioned, the environment metadata relates to background sounds and is used to determine user surroundings by analyzing background sounds that might include sounds of vehicles, people, animals, machines etc. By analyzing the environment metadata, the technology can determine the kind of surrounding the user is in, and accordingly suggest appropriate content.

Along with the content metadata and the environment metadata, the technology also uses user’s history, music collection and additional inputs from the user like artists or genres for recommending appropriate content.

Based on the inputs received, the technology provides appropriate audio or visual output.

Companies file numerous patent applications in notion of incorporating the patented technologies in near future. However, only few make it to the market. Spotify expressed that the current technology is still in concept stage and requires work and refinement.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

Indian Design Amendment Rules 2021

On January 25, 2021, the Ministry of Commerce and Industry (MCI) notified the Designs (Amendment) Rules, 2021 in the Official Gazette.

The following amendments have been made:

-

Rule 2(eb) has been introduced. The sections defines and recognizes start-ups as a category of applicant. To claim start-up status, the following criteria must be satisfied:

- Indian entities must be recognised as a startup by the competent authority under the Union Government’s Startup India initiative

- In the case of foreign entities, the criteria for turnover and period of incorporation or registration as per Startup India Initiative must be fulfilled. Further, a declaration to that effect to that effect must be submitted.

- The Proviso in Rule 4 has been substituted to include mobile numbers in the address for service.

- Rule 5(e) which specifies the payment of fees in case of transfer of application, has been substituted. In the event that an application filed by a natural person/start-up or a small entity is transferred (partially or completely) to an entity which does not qualify as a start-up, small entity or a natural person, then in such cases, the difference in the scale of fees (if any) between the fees charged from the natural person, startup or small entity and the fees applicable for the new entity are to be paid by the new applicant along with the request for transfer. This does not apply in a case where a start-up or a small-entity cease to be a start-up or a small-entity.

- Rule 10 (1) which specifies the registration of designs, has been substituted. With this, India has now formally adopted the Locarno Classification. Previously, the Indian Designs Office maintained its own Classification system which was almost in line with the Locarno Classification. However, the new Amendment Rules have eliminated any discrepancies that existed previously. The Third Schedule, which provided the Indian Design classification, has now been omitted.

- Schedule I, which specifies the fees, has been substituted. The revised Schedule now provides for differences in costs which may be imposed depending on the nature of the entities involved in proceedings. Similarly, the scale of Costs in Fourth Schedule has been substituted to include costs which depend on the nature/category of the applicant.

- In Schedule II, Form 1 has been substituted. The amendment is minor and is made to include start-ups as an applicant category. Similarly, Form 24 has also been substituted to incorporate start-ups as a category of applicants.

We hope this information was useful.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

Microsoft Gets Patent for Chatbot That Lets You Talk to Dead People

In December 2020, the USPTO granted a patent to Microsoft for a tool that apparently makes it possible to have a conversation with a Chatbot that bears resemblance to a deceased loved ones or historical figures.

According to the patent information, the tool would gather and rely on social data like letters, images, messages, and social media posts from the chosen individual. The information would then be used to train the Chatbot to interact like a 2-D or even a 3-D model of that person.

The application for patent was filed in April 2017, and therefore, it predates the AI ethical standards prevalent today. However, Microsoft has not confirmed any plans for using this technology in the near future.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 84

- Next Page »

Follow

Follow