Updated tax rates for transfer or permitting the use of Intellectual Property rights in India

On 30th September, 2021 by issuance of Notification No. 06 /2021- Central Tax (Rate) by the Ministry of Finance of India. The notification made the following amendments to the notification of the Government of India, in the Ministry of Finance (Department of Revenue) No.11/2017- Central Tax (Rate), dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 690(E), dated the 28th June, 2017:

(i) in the Table, –

(b) in serial number 17, –

(A)item (i) and the entries relating thereto in columns (3), (4) and (5) shall be omitted;

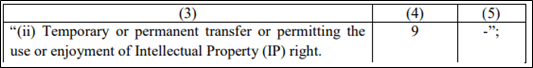

(B) for item (ii) and the entries relating thereto in columns (3), (4) and (5), the following entries shall be substituted, namely:-

In this notification, Ministry of Finance of India, increased the Central Goods and Services Tax (CGST) levied on IP from 6% to 9%. Following which the state governments released a notification updating the State Goods and Services Tax (SGST) levied on IP from 6% to 9%. This as a result increased the overall GST levied on temporary or permanent transfer or permitting the use of enjoyment of Intellectual Property (IP) right, from 12% to 18%. Additionally, the notification amended the GST rate levied on IP’s not relating to Information Technology (IT) software from 6% to 9% which is now same as GST rate levied on IP’s relating to IT software. This amendment addresses the questions/issues that were encountered while categorizing and calculating fees to be paid for certain inventions nearly relating to IT software while dominated by concepts and components relating to other disciplines.

On 27th October, 2021 by issuance of Notification No. 13/2021- Central Tax (Rate) by the Ministry of Finance of India. The notification made the following amendments to the notification of the Government of India, in the Ministry of Finance (Department of Revenue), No.1/2017-Central Tax (Rate), dated the 28th June, 2017:

(b) in Schedule III – 9%, against S. No. 452P, in column (3), the words “in respect of Information Technology software” shall be omitted.

On 27th October, 2021 by issuance of Notification No. 13/2021- Integrated Tax (Rate) by the Ministry of Finance of India. The notification made the following amendments to the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.1/2017-Integrated Tax (Rate), dated the 28th June, 2017:

(b) in Schedule III – 18%, against S. No. 452P, in column (3), the words “in respect of Information Technology software” shall be omitted

By way of all these notifications, Ministry of Finance of India, increased the Integrated GST (IGST), which includes both central and state tax rates, levied on any “Temporary or permanent transfer or permitting the use or enjoyment of Intellectual Property (IP) right” from 12% to 18%. This change will make the GST levied on IP’s not relating to IT software same as the GST levied on IP’s relating to IT software. This amendment undeniably increases the financial burden on the IP owner, which in turn might discourage an inventor with lesser financial resources available at his/her disposal. Also, it needs to be pointed out for the sake of simplicity here that these changes to IGST rates relating to IP’s is applicable to any kind of temporary, permanent transfer, or renting, or leasing the IP to someone else.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

Follow

Follow

Leave a Reply