Tag Archives: MSMED small entity

80% Reduction in patent fees for Educational Institutions – A much awaited booster for patenting new Ideas in India

Indian Educational Institutions have been the hub of some of the most innovative minds. An amalgamation of ideas from a student and teacher during a learning process can foster substantial innovation. But one thing that was lacking so far was the affordability to legally own and monetize these ideas by the fraternity in educational institutions.

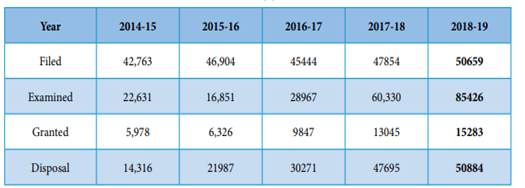

The Annual report of the Indian Patent office for the year 2018-19 indicated that the number of patents filed have steadily increased on a yearly basis as shown below:

Trends in Patent Applications:

Courtesy: Annual Report 2018-19 by Indian Patent Office

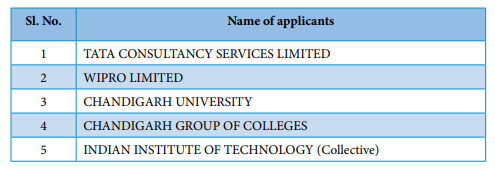

However, when we look at the top 5 Indian applicants for patents, we observe that very few educational institutions make it to the top 5 applicants’ list in India. Also, the number of patents filed by all the educational institutions in India put together is hardly 2% of the total number of patents filed in India.

Top 5 India applicants for patents in the field of Informatioon Technology

Courtesy: Annual Report 2018-19 by Indian Patent Office

Therefore, a rebate of 80% according to the notification published on 21st September 2021, by the Ministry of Commerce and Industry, will now attract more and more projects to be filed and monetized by educational institutions across the nation. In accordance with the notification, the Central Government has made certain rules to amend the Patent Rules, 2003. The amended rules are called Patent (Amendment) Rules, 2021, and has come into force on the date of their publication in the Official Gazette. The key takeaways of the notification are as follows:

|

Sl. No |

Rules |

Sub-Rule |

Inference |

|

1. |

2 |

(ca) “educational institution” means a university established or incorporated by or under Central Act, a Provincial Act, or a State Act, and includes any other educational institution as recognized by an authority designated by the Central Government or the State Government or the Union territories in this regard; |

All the universities and other educational institutions recognized by any one of the Central Government, State Government or Union Territories will hence forth be recognized as “educational institution” by the Indian Patent Office for categorizing under the right fee slab. |

|

2. |

7 |

(1) Provided further that in the case of a small entity, or startup, or educational institution, every document for which a fee has been specified shall be accompanied by Form-28. |

The filing fee for educational institution is same as the filing fee for a natural person, small entity or a startup. |

|

|

|

(3) In case an application processed by a natural person, startup, small entity or educational institution is fully or partly transferred to a person other than a natural person, startup, small entity or educational institution, the difference, if any, in the scale of fees between the fees charged from the natural person, startup, small entity or educational institution and the fees chargeable from the person other than a natural person, startup, small entity or educational institution, shall be paid by the new applicant along with the request for transfer. |

In case the educational institution chooses to transfer their processed application to any entity other than a natural person, small entity or a startup, the difference in the chargeable fees must be paid by the new applicant. |

|

3. |

First Schedule |

Headings and sub-headings in Table 1. |

“educational institution” is included in the heading and sub-heading of Table 1 along with natural person, small entity and a startup. |

|

4. |

Second Schedule |

Form 28 |

“educational institution” is included in Form 28 along with natural person, small entity and a startup. |

Who will qualify as an educational institution?

In accordance with the newly amended Rule (2) (ca), for an Indian applicant, an “educational institution” is a university established or incorporated by or under Central Act, a Provincial Act, or a State Act. Further, any other educational institution recognised by an authority designated by the Central Government or the State Government or the Union territories will also be recognised as an educational institution in India. A foreign applicant can qualify as an educational institution by furnishing any legal document to ascertain the same.

How can an educational institution claim the benefits of educational institutions?

In accordance with the newly amended Rule (7), the educational institutions are recognized on par with a small entity or a startup and are therefore entitled to file the required documents using the new Form -28. Further, the scale of fees chargeable for an educational institution is on par with a small entity or a start-up.

CONCLUSION

Most of the educational institutions take a minimum of 10 years to establish themselves. Their profits do not alter according to the industrial requirements. Therefore, recognizing them on par with a small entity thereby reducing the filing fees by 80%, will make it easy for young innovators to legally protect their innovations.

Further, the provision of 80% rebate for filing patents by educational institutions seems like a win – win opportunity for both the government as well as the educational institutions. On one hand, by reducing the filing cost for patents filed by educational institutions, the Government has channelized the innovative ideas towards strengthening the Indian Economy. On the other hand, a greater number of educational institutions will now be willing to file patents of innovative projects carried out by students under the guidance of their respective mentors. This in turn will provide an added income to the educational institutions once the patents are monetized.

Moving in this direction, the Andhra University has welcomed the new rule by setting up an exclusive centre for Intellectual Property (IP) within its campus. The IP centre will henceforth oversee the documentation process and bear the cost of filing for IP rights of researchers in Andhra University. On the whole, this new rule has set a platform to utilize the vibrant young minds towards building a strong economy thereby contributing to the growth of the nation.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-Non Commercial 3.0 Unported License

How to claim small entity status while filing for patents in Indian Patent Office

Qualifying as a Small Entity

Under the Indian Patents Rules, 2003, rule 2(fa) defined “small entity” as:

(i) in case of an enterprise engaged in the manufacture or production of goods, an enterprise where the investment in plant and machinery does not exceed the limit specified for a medium enterprise under clause (a) of sub-section (1) of section 7 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006); and

(ii) in case of an enterprise engaged in providing or rendering of services, an enterprise where the investment in equipment is not more than the limit specified for medium enterprises under clause (b) of sub-section (1) of Section 7 of the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006).

Explanation 1. — For the purpose of this clause, "enterprise" means an industrial undertaking or a business concern or any other establishment, by whatever name called, engaged in the manufacture or production of goods, in any manner, pertaining to any industry specified in the First Schedule to the Industries (Development and Regulation) Act, 1951 (65 of 1951) or engaged in providing or rendering of any service or services in such and industry.

Explanation 2. — In calculating the investment in plant and machinery, the cost of pollution control, research and development, industrial safety devices and such other things as may be specified by notification under the Micro, Small and Medium Enterprises Development Act, 2006 (27 of 2006), shall be

excluded.

Explanation 3. —The reference rates of foreign currency of the Reserve Bank of India shall prevail.

In July 2020, the government of India revised the definition of a “Small Enterprise”. An applicant may claim the status of a “Small Entity” if the following criteria can be fulfilled:

- Investment in Plant and Machinery or Equipment does not exceed INR 50 crore (USD 68,64,125 approx)

- Annual Turnover does not exceed INR 250 crore (USD 3,43,20,625 approx)

Documents required as Proof

An applicant wishing to be declared as a small entity, has to file a declaration in Form 28, and furnish proof relating to the status of being a small entity. If an applicant wishes to file a new patent application, a form 28 should accompany form1. However, if the applicant has already filed a patent application, and wishes to file any other forms which attracts a fee, form 28 should be filed at least once accompanying the form which the applicant desires to file. Further, to substantiate a Form 28 filing, the following documents will be required:

-

Indian applicant:

- Evidence of registration under the Micro, Small and Medium Enterprises Act, 2006 (i.e. the MSME or Udyog Aadhar Certificate). You may go through this link to obtain the same.

-

For a non-Indian applicant:

- A self-declaration regarding small entity status

-

Any document as evidence of eligibility

- A self-attested copy of the latest balance sheet in English and a self-attested copy of the latest profit and loss statement in English.

- A certificate/declaration from a Chartered Accountant.

Eligibility for Expedited Examination:

Under the Indian Patents Rules, applicants (Indian or foreign) in the “Small Entity” category may file a request for expedited examination in Form 18-A. However, it must be accompanied by Form-28.

Reduced Government Fee:

Under Patents (2nd Amendment) Rules, 2020 notified on November 04, 2020), the types of Applicants for a patent application have been classified into 2 categories, namely:

- Natural person(s) or Startup(s) or Small entit(y)/(ies)

- Other(s) (i.e. commonly called large entities)

Now, Small Entities enjoy a concession (80%) in the IPO fees.

Conclusion

In light of this, applicants wishing to claim small entity status need to furnish certain proof and documentation to claim this status. This article tries to help such applicants to claim small entity status.

We hope you found this article useful. You may be interested in reading our articles:

How much does it cost to get a patent in India?

Filing a national phase patent application in India after filing a PCT application

Feel free to write to us at [email protected]

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-NonCommercial 3.0 Unported License

Follow

Follow