Tag Archives: indian patent office examination delay

India working towards disposing pending patent applications in the next two years

Minister for Commerce and Industry, under which the Department of Industrial Policy and Promotion (DIPP) functions, has been taking several initiatives for substantive improvement of IP environment in India. The recent initiatives include comprehensive National IPR policy, relocation of Copyright Office to DIPP, merger of the Copyright Board with the Intellectual Property Appellate Board (IPAB), establishment of Cell for IPR Promotion and Management (CIPAM) and launch of Start-up Intellectual Property Protection (SIPP) scheme, among others.

Adding to the above initiatives, the office of Controller General of Patents, Designs and Trade Marks (CGPDTM) is making efforts to clear the backlog of about 2.3 lakh pending patent applications. DIPP has hired substantial number of examiners and is likely to dispose these pending applications in next two years. The introduction of expedited examination and the recruitment of around 450 patent examiners to add to the pool of existing 130 examiners at the Intellectual Property Office (IPO) is witness to such efforts of the DIPP. This recruitment has increased the speedy disposal of pending patent applications. In the year 2016-17, about 9,847 patents were granted by the IPO, as against 6,326 in the previous year. IPO has improved its count in issuance of examination reports, which has increased to 6,000 patent applications a month from the earlier 1,500 applications.

Suresh Prabhu, Minister for Commerce and Industry, while addressing the Leadership Summit on Anti-Counterfeiting and Brand Protection at New Delhi last month, highlighted the efforts and initiatives of DIPP and IPO to dispose off the pending applications at the earliest. He announced that the Ministry is working to come up with an effective plan by which patent applications will be disposed in the least possible time. These initiatives are expected to bring down the pendency of patent applications and targeted at final disposal of patent applications from the present 5-7 years to less than 18 months.

We welcome the initiatives and efforts of the ministry in establishing a strong IP regime, and more importantly a time bound one, which is likely to boost innovation in the country.

We hope this article was a useful read.

Please feel free check our services page to find out if we can cater to your requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-NonCommercial 3.0 Unported License

The Indian Patent Office – A Cash Cow Left to Starve

India is fast emerging as a major market for research and technology driven products. One of the key indicators of this fact is the number of patent applications filed in India. As per a report from World Intellectual Property Organisation (WIPO), India stood at the 8th position leaving behind Canada in the year 2012, in quantum of patent application filings. With the steady increase in filing of patent applications, the revenue generated by the Controller General of Patents, Designs and Trademarks (CGPDTM), which is commonly known as Intellectual Property Office (IPO), has increased.

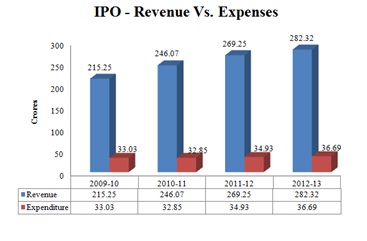

The IPO generated revenue of a little over 282.32 crores in 2012-13 compared to 269.25 crores generated in 2011-12. While the revenue has increased at a steady rate in the past few years, the IPO is all set to witness a sharp increase in revenue this financial year, thanks to massive increase in the statutory fee charged by the IPO for various patent filing, prosecution and maintenance activities.

Earlier the IPO had two slabs of statutory fee based on the category of patent applicants or patent owners. The IPO had two categories, i.e. “Natural Persons” (NP), such as individuals, and “Other than Natural Persons” (ONP), such as companies. The fee for the second category was 4 times of what was being charged for the first category. The IPO upon revision of its fee has made three categories, namely, NP, small entity (a legal entity who can be categorized as SME), ONP (a large entity – a legal entity who cannot be categorized as SME). The revised fee charged for small entity is 2.5 times of what is be charged for NP, and the fee for ONP is 5 times of what is charged for NP.

One would realise that the manner in which the fee has been revised by the IPO has been rather smart if one were to look at data closely. The increased fee for NP is negligible considering the minuscule factor of the IPO fee in the entire patenting process. SMEs who were earlier complaining about being charged the same fee as was being charged for large enterprise have been granted relief by offering to charge 2.5 times of NP, as compared to 4 times of NP, as was being done earlier. Large enterprise however will feel the pinch of the increased fee, but they might have hardly any reason to complain considering remarkably high government fee charged by most countries, to which most of them are already exposed.

The IPO has done remarkably well by pleasing the general masses of individuals and SMEs with its pricing structure, while cleverly making a killing, as the IPO generates majority of its revenue from companies who are categorized as large entities, who will now see a 100% increase in fee in most cases.

The IPO while being a cash cow generating impressive revenue, which is now set to increase significantly, spends a small percentage on its operations. In the year 2012-13, the IPO generated 282.32 crores and spent only 36.69 crores on its operations. The story has remained the same over the years.

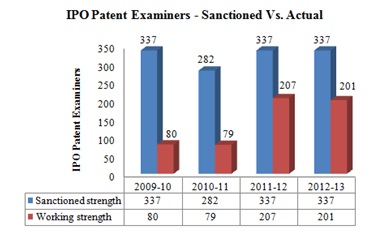

Even though the IPO generates revenue surplus year after year, it has failed to meet its sanctioned working strength over the years, which has snow balled into an operational crisis. For example, the sanctioned strength of patent examiners stands at 337, while the working strength is 201, falling short by 40%! Shortage of employees can be witnessed across various departments and posts at the IPO.

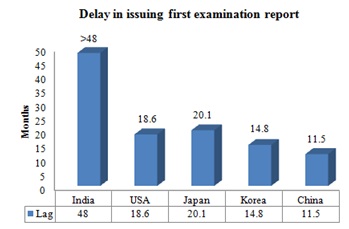

One of the key indicators of the operational crisis at the IPO is the lag between patent application filing and issuance of patent application examination report by the IPO. At present, the lag is well over 48 months. In other words, a patent applicant has to wait for over 4 years after filing a patent application to receive an opinion on patentability from the IPO. A comparison of such lag in other countries indicates the dismal performance of the IPO.

This operational crisis may not be addressed even if the IPO were to meet its sanctioned working strength. The sanctioned strength is far too less to examine well over one lakh patent applications that have piled up over the years. Even if one were to ignore the pending patent application, the sanctioned strength is not even sufficient to examine patent applications that are currently being received. The IPO received 36247 examination requests in 2012-13, and in order to examine these within one year, each examiner (as per sanctioned strength) on an average will have to examine 107 patent applications in a year, which is not a feasible proposition reinforced by the fact that the IPO with 201 patent examiner clocked an average of examining 61 patent applications per year per examiner.

The IPO has done well in restructuring its fee structure, and patent applicants hope to see similar move by the IPO in restructuring its operations. Restructuring operations may include increasing its workforce and subscribing to initiatives such as Patent Prosecution Highway (PPH), which is a work sharing initiative between major patent offices across the world. Such operational restructuring which is required to make the Indian market more attractive to investors will of course require extensive support from the newly formed central government which has come to power on the “development” plank.

Data for graph

IPO – Revenue Vs. Expenses

|

Year |

Revenue (crores) |

Expenditure (crores) |

|

2009-10 |

215.25 |

33.03 |

|

2010-11 |

246.07 |

32.85 |

|

2011-12 |

269.25 |

34.93 |

|

2012-13 |

282.32 |

36.69 |

IPO Patent Examiners – Sancioned Vs. Actual

|

Year |

Sanctioned strength |

Working strength |

|

2009-10 |

337 |

80 |

|

2010-11 |

282 |

79 |

|

2011-12 |

337 |

207 |

|

2012-13 |

337 |

201 |

Delay in issuing examination report

|

Country |

Lag (months) |

|

India |

48 |

|

USA |

18.6 |

|

Japan |

20.1 |

|

Korea |

14.8 |

|

China |

11.5 |

Sources used for research:

http://ipindia.gov.in/main_text1.htm

http://ipindiaservices.gov.in/ferstatus/

http://www.uspto.gov/dashboards/patents/main.dashxml

http://www.fiveipoffices.org/stats/statisticalreports/2012edition/IP5statistics2012.pdf

I hope you found this article interesting. You may also read our related articles:

- How Long Does it Take to Get a Patent?

- How soon after filing a patent application in India, will it be examined?

Please feel free check our patent services page to find out if we can cater to your patent requirements. You can also contact us to explore the option of working together.

Best regards – Team InvnTree

This work is licensed under a Creative Commons Attribution-NonCommercial 3.0 Unported License

Follow

Follow